The mobility industry is undergoing a massive transformation … and the consumer experience sits at a crossroads.

Learn how the Experiences Per Mile (EPM) Advisory Council

plans to promote advancements that benefits the consumer.

EXPLORE

A RAPID INDUSTRY

DISRUPTION

After more than a century of business as usual, the mobility industry has set forward an ambitious course of innovation focused on vehicles that are:

Source: SBD AUTOMOTIVE

Source: SBD AUTOMOTIVE

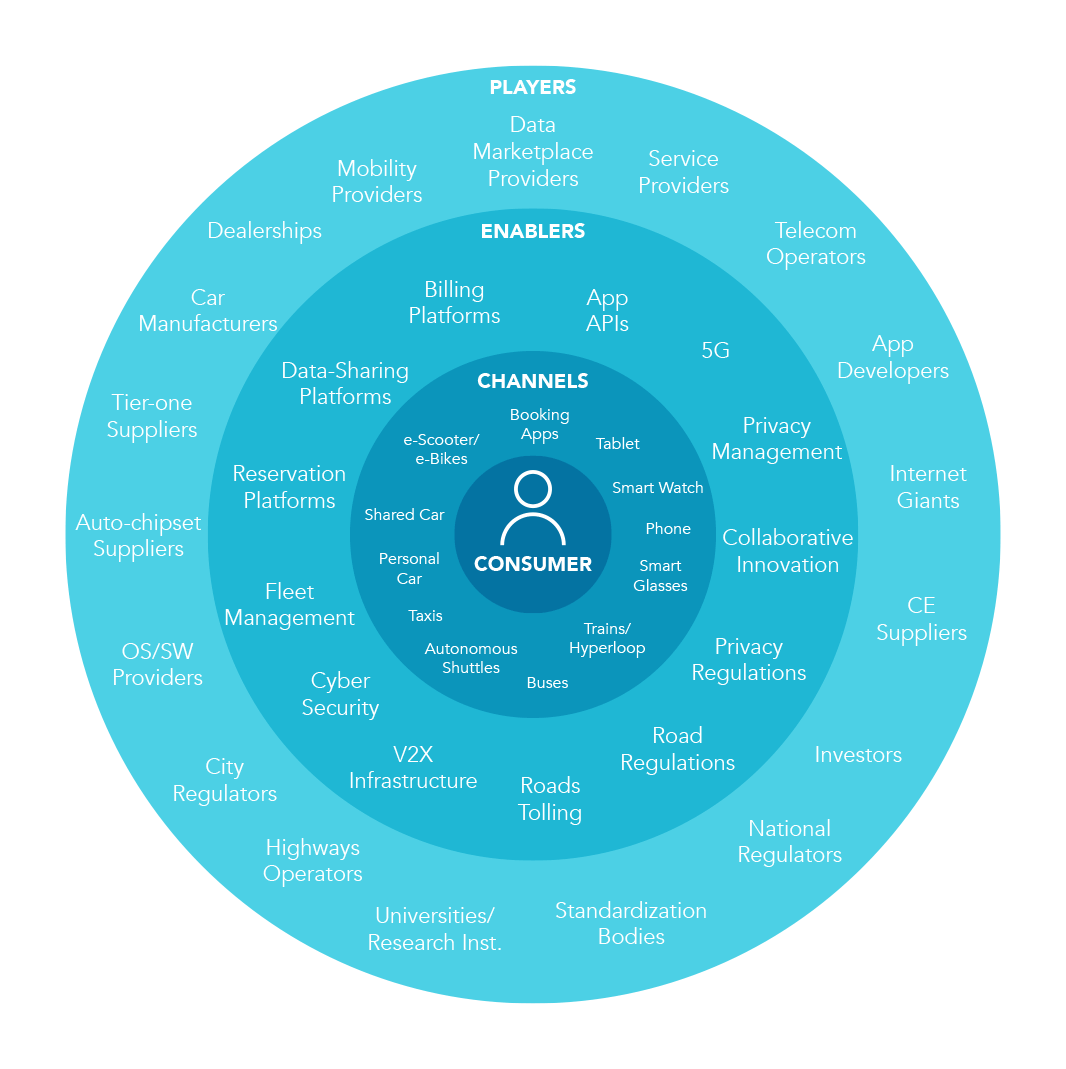

This transformation is largely influenced by the complex mobile ecosystem

Data is becoming

industry’s new fuel

The mobility industry transformation is being fueled by the growing quantity and availability of vehicle and mobility data.

Data is driving forward progress in five ways:

“Our research underscores the importance of developing consumer-facing apps that inform consumers about how their data can be used. These apps need to be able to share consent information across the ecosystem of companies working with connected car data.”

But with more connectivity and data, concerns about privacy, data protection and personal security have also risen.

According to recent surveys, 60 percent of respondents say it’s very important to be told exactly what data is being collected, how it’s being used and by whom when deciding whether to share their data.

“Attackers are increasingly looking to monetize data and target victims via various means… the security of mobility platforms needs to be considered from design to supply chain to experience.”

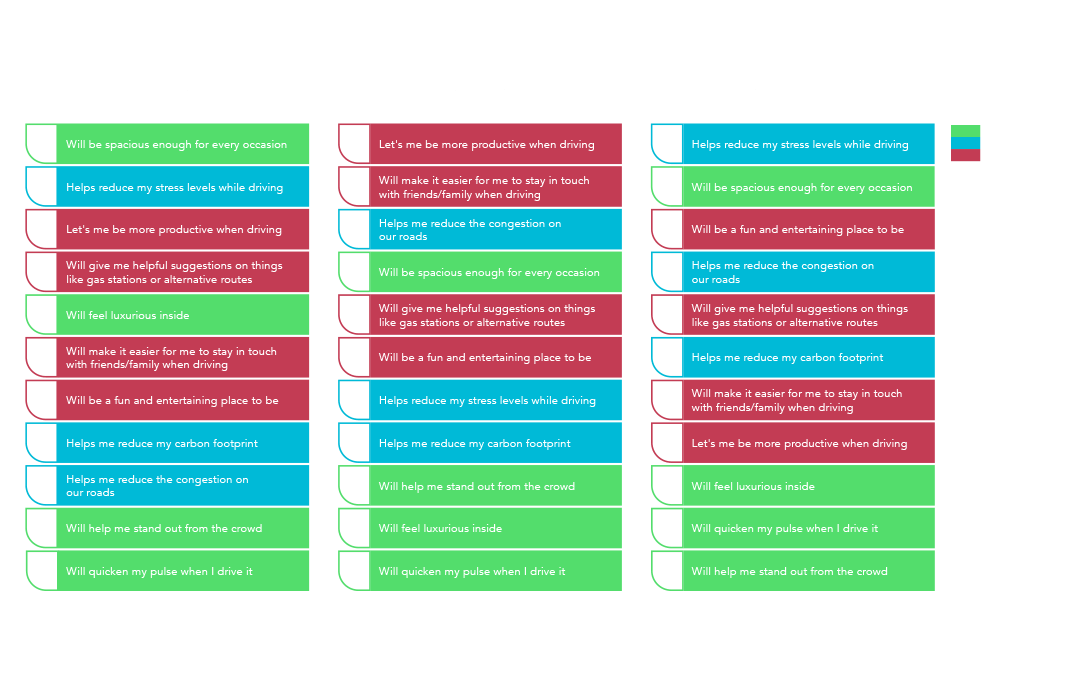

A survey was conducted with current connected car drivers in the USA (2018) and Europe (2020) to gage their interest in services based on connected car data. See list of services evaluated below. Of those who expressed interest in each service, approximately 80 percent were willing to share anonymous or personal connected car data to gain access to these capabilities.

Interest in Connected Car Services, Europe vs. US

“High Definition ‘live maps’, meaning a digital representation of the world that is fresh, accurate, and rich in attribution are becoming increasingly important to enable various autonomous and mobility experiences. Our self-healing mapping technology enables us to analyze data from multiple sources, such as satellite imagery, probe and crowd-source vehicle sensor data in real-time, allowing our maps to always Protect: Data is the primary enabler for staying fresh and reliable.”

Mobility customers

are feeling the pain

Despite the advances in the mobility industry,

consumers still face many pain points.

The EPM Advisory Council conducted a short survey in March 2020 to understand the true scale of the challenge that consumers like Jacob face in their day-to-day journeys. The survey was conducted in the USA, Europe, China and included 1,000 recent car buyers. The key findings were:

Despite an increasing reliance on technology, cars regularly rank at the bottom of all digital devices in terms of ease of use. In a recent survey, consumers were asked to rank how difficult it is to perform common digital tasks in a car when compared to other digital devices:

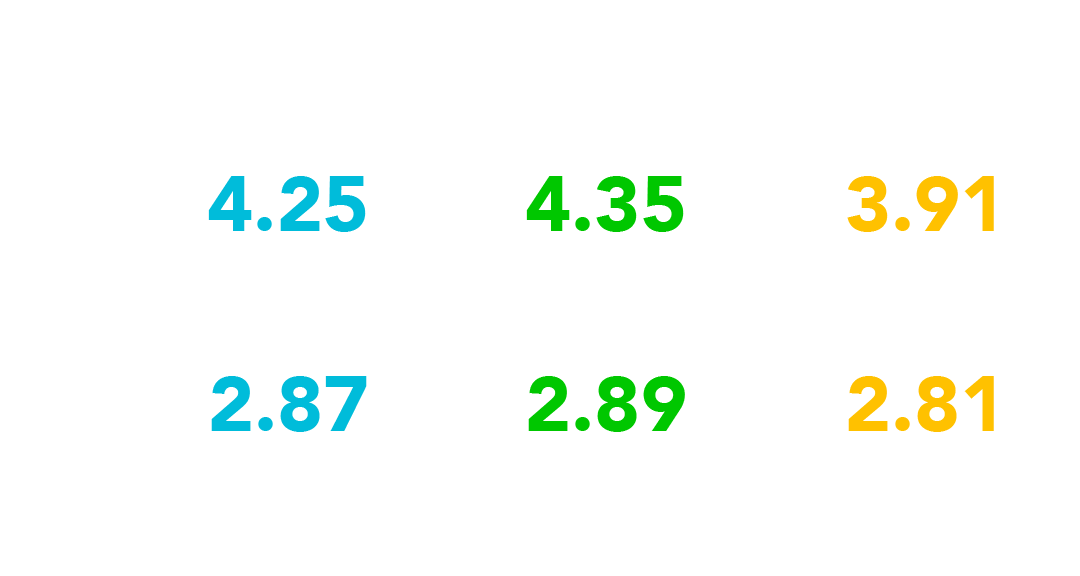

Question: On a scale of 0 to 10, with 0 being near impossible and 10 being extremely easy, how easy is it to do the following activities when using your device?

Note: Results show % of respondents who gave a score of 6-10

We also asked consumers how their technology use is increasing when compared to its growing complexity:

While people are relying on technology more than ever before (particularly in China), a sizable proportion of respondents feel that technology is getting too complicated (particularly in the USA). This is likely a reflection that while many of the devices people rely on may work well individually, integrating these devices into a seamless digital experience is getting harder.

Question: How much do you agree or disagree with the following statements?

Note: Results show mean rating of statement using a scale of 1 to 5, with 1 being strongly disagree and 5 being strongly agree.

With consumers spending more time than ever in their cars (an average of 225 hours per year), these pain points are only growing.

The EPM Advisory Council found that the root causes of consumer pain points are:

In this video, we explore pain points from real, everyday mobility consumers.

“[Solutions] really start with the consumer pain points and understanding the consumer insights. Then, we can solve for those consumer pain points during the in-vehicle experience.”

To address consumer pain points, the auto industry needs to focus on delivering hyper-individualized mobility experiences.

These experiences should be built on our Consumer Experience Pillars:

SOURCE: HARMAN INTERNATIONAL

Traditionally, car buying was heavily influenced by a vehicle’s physical factors such as aesthetics and performance. Our survey shows that many of these traditional factors are being overtaken by new considerations, such as how well the vehicle integrates with a person’s digital lifestyle.

Question: Rank in order of importance the key things you may look for in the next car you buy.

Note: Results show % of respondents who placed criteria within their top 5

“The customer journey represents hundreds of thousands of dollars over the lifetime of a single customer.”

Source: SAPCustomer satisfaction impact

+15% -20%

Maximizing satisfaction with customer journeys can lift revenue by up to 15% while lowering the cost of serving customers by as much as 20%

SOURCE: MCKINSEY & COMPANYHow collaborative innovation

will inspire real change

No single company can accomplish everything alone. Instead, the mobility ecosystem will need to collaborate and innovate.

We believe real change begins with:

“Joining the EPM Advisory Council has been an enlightening experience for myself and my colleagues to date. Bringing together various industries from mobility, autonomy to entertainment has shown we are all working towards the same goal. As we work towards defining the vital KPI’s for the EPM we will determine best practices and processes to allow us to create a greater user experience. Defining the metric which is easily understood by the consumer will help to make EPM successful.”

“Providing our retail customer with an end to end digital experience that does not stop when they leave the car is central to our value proposition as a trusted mobility provider. Additionally, serving our commercial and fleet customers digital needs is paramount; they own their vehicles to run their business or generate revenue – an increased level of digital in-vehicle and off-vehicle products and services is key.”

“Earlier this year, Hyundai became the first mainstream automaker to launch a Smartphone Digital Key. Digital Key adds convenience for our owners who are used to using their phones for everything. Customers want to manage their lives with a smartphone. More importantly, wide adoption of Digital Key allows us to be ready for future shifts in mobility, such as car sharing and alternative ownership models.”

A clear roadmap for the next

decade of mobility success

The journey to deliver the bright future of mobility starts with a common purpose – and the EPM Advisory Council is dedicated to creating a common purpose that is consumer centric.

That’s why the EPM Advisory Council created a roadmap for the next decade:

EXPERIMENTATION AND LEARNING

Passengers and companies are taking risks and learning new ways of “being moved”. Customers are experiencing new forms of mobility, paying, accessing services, delivery, and companies are investing billions in testing new business models.

THE EXPERIENCE ECONOMY

The car is a favorite place. Consumers see the vehicle as a space be more entertained, more productive, more… everything. The growing maturity of higher-levels of autonomy helps consumers regain much-valued time, and their mobility solutions help them make the most of that time through improved productivity, social interactions or healthy living.

WISDOM BUILT ON DEEP INSIGHTS

Insights drive more to an ecosystem mindset and accelerate collaboration. Data and insights provide new players and existing investors to think in new ways of enhancing the customer experience. Companies start working together to enable the consumer to make optimal choices about their mobility experience.

MESHED ECOSYSTEM OF MOBILITY AND LIVING

Break the mold of the form factor—the “vehicle” is the doer. It brings “destinations” to you, rather than taking you from point A to point B. In this era, the home is as much a part of the mobility experience as the car. This is a time when you can delegate to the “vehicle,” where it can pay, transact and complete tasks for you. Mobility providers build integrated experiences into all products in a consumer’s life: home, car and devices. Consumers evolve from “Owning a Premium Car” to “Living a Premium Life.”

The role of the

epm advisory council

To transform the mobility industry and media dialogue, HARMAN, SBD Automotive and industry partners have recently formed the Experiences Per Mile Advisory Council.

This council’s mission is to promote collaboration, establish processes and elevate the automotive ecosystem as a whole.

“The purpose of the Experiences Per Mile Advisory Council is to uncover best practices and foster cross-industry collaboration… The greatest benefit of the Advisory Council [is that] the consumer will have a much better experience while moving from one location to another.”

Ensuring the next decade of mobility transformation puts the consumer first and foremost

To read more about the future of consumer-centric mobility,